MACD Histogram

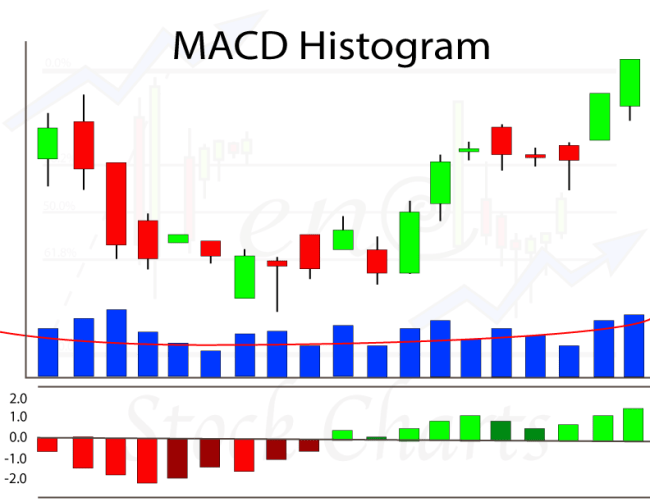

At first glance, the MACD Histogram chart indicator can easily be confused with the volume bars on a stock chart.

At first glance, the MACD Histogram chart indicator can easily be confused with the volume bars on a stock chart.

Unlike volume bars though, the MACD Histogram assigns negative values to its selling bars. Negative bars on a MACD represent selling momentum. Positive bars represent buying momentum.

The MACD Histogram is typically not a default chart indicator selection on most trading platforms. Typically you must load the indicator onto the chart you are viewing.

Because the MACD Histogram can be a useful charting indicator for both traders and investors, I would consider saving the MACD Histogram as part of your "default chart set-up". As part of a default set-up, the indicator will automatically load each time you pull up a stock chart.

While there are literally hundreds of indicators out there to chose from, I recommend that a person uses no more than 4 total chart indictors. Using more than 4 indicators can create confusion and indecision. You want to be decisive when trading and investing. I tend to use 2 indicators most times. The MACD Histogram is 1 of them. Let's review some of the reasons why the MACD Histogram should definitely be 1 of the 4 indicators in your charting toolbox.

A MACD Histogram illustrates the amount of buying or selling momentum for a stock. A MACD Histogram chart indicator is typically illustrated at the very bottom of a chart as I've illustrated.

The zero line for the MACD Histogram represents neutrality, no buying or selling momentum. A negative reading for the MACD Histogram represents selling momentum. A positive reading for it represents buying momentum. Let's review some of the components and colors for this technical analysis indicator.

Components

On the left side of my illustration are the readings for the MACD Histogram. However, I use more of a visual approach when I use this chart indicator. I rely more on the visual presentation, including the colors, of the MACD Histogram than the actual readings.

Some trading platforms, like TD Ameritrade that I use, allow you to customize the colors of your trading tools. That is what I did for the MACD Histograms displayed on my stock charts. I set up the colors of the MACD Histogram as follows:

- Bright Green - Increasing Buying Momentum (section E)

- Dark Green - Decreasing Buying Momentum (section D)

- Bright Red - Increasing Selling Momentum (section A)

- Dark Red - Decreasing Selling Momentum (section B)

By using a standardized color coding system for the MACD Histogram, I can quickly read the indicator without much effort.

Let's review some of the differences you might see with the indicator when looking at a daily, weekly and monthly candlestick chart for the same company over the same 1 year period.....

If you want to continue reading more about the MACD Histogram, including how to use this indicator for both short-term trading and longer-term investing, then you must first login.

If you are not a Trendy Stock Charts member, consider subscribing today! There are several different subscription plans available!

You must be logged in to post a comment.