MACD Histogram

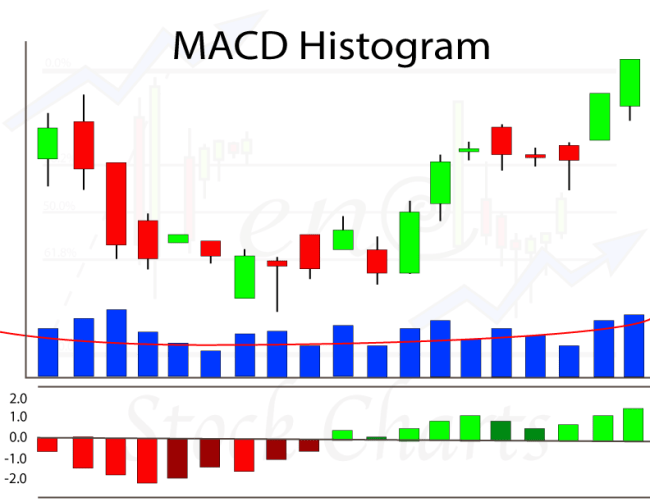

At first glance, the MACD Histogram chart indicator can easily be confused with the volume bars on a stock chart.

At first glance, the MACD Histogram chart indicator can easily be confused with the volume bars on a stock chart.

Unlike volume bars though, the MACD Histogram assigns negative values to its selling bars. Negative bars on a MACD represent selling momentum. Positive bars represent buying momentum.

The MACD Histogram is typically not a default chart indicator selection on most trading platforms. Typically you must load the indicator onto the chart you are viewing.

Because the MACD Histogram can be a useful charting indicator for both traders and investors, I would consider saving the MACD Histogram as part of your “default chart set-up”. As part of a default set-up, the indicator will automatically load each time you pull up a stock chart.

While there are literally hundreds of indicators out there to chose from, I recommend that a person uses no more than 4 total chart indictors. Using more than 4 indicators can create confusion and indecision. You want to be decisive when trading and investing. I tend to use 2 indicators most times. The MACD Histogram is 1 of them. Let’s review some of the reasons why the MACD Histogram should definitely be 1 of the 4 indicators in your charting toolbox.

A MACD Histogram illustrates the amount of buying or selling momentum for a stock. A MACD Histogram chart indicator is typically illustrated at the very bottom of a chart as I’ve illustrated.

The zero line for the MACD Histogram represents neutrality, no buying or selling momentum. A negative reading for the MACD Histogram represents selling momentum. A positive reading for it represents buying momentum. Let’s review some of the components and colors for this technical analysis indicator.

Components

On the left side of my illustration are the readings for the MACD Histogram. However, I use more of a visual approach when I use this chart indicator. I rely more on the visual presentation, including the colors, of the MACD Histogram than the actual readings.

Some trading platforms, like TD Ameritrade that I use, allow you to customize the colors of your trading tools. That is what I did for the MACD Histograms displayed on my stock charts. I set up the colors of the MACD Histogram as follows:

- Bright Green – Increasing Buying Momentum (section E)

- Dark Green – Decreasing Buying Momentum (section D)

- Bright Red – Increasing Selling Momentum (section A)

- Dark Red – Decreasing Selling Momentum (section B)

By using a standardized color coding system for the MACD Histogram, I can quickly read the indicator without much effort.

Let’s review some of the differences you might see with the indicator when looking at a daily, weekly and monthly candlestick chart for the same company over the same 1 year period[s2If !current_user_can(access_s2member_level1)]…..

If you want to continue reading more about the MACD Histogram, including how to use this indicator for both short-term trading and longer-term investing, then you must first login.

If you are not a Trendy Stock Charts member, consider subscribing today! There are several different subscription plans available![/s2If][s2If current_user_can(access_s2member_level1)].

VRX – 1 Year Daily Candlestick Chart

This is a 1 year daily candlestick chart. It shows selling momentum that has been gradually increasing for VRX over the last 2 weeks. The selling momentum is increasing as VRX attempts to make a new high in its current uptrend. So far, VRX has failed to break above the current uptrend’s high.

The MACD Histogram for Valeant Pharmaceuticals (VRX) on this Daily Candlestick Chart Shows Gradually Increasing Selling Momentum Over the Last 2 Weeks

This is a bearish divergence that is setting up on VRX’s daily candlestick chart. A Bearish Divergence is when the share price is making new highs but there is selling momentum that has started and is increasing.

VRX – 1 Year Weekly Candlestick Chart

This is the same time frame of 1 year for the chart. But instead of a daily chart, this is a weekly chart for VRX. Notice the difference between the MACD Histogram reading on VRX’s daily chart above and this weekly chart.

The MACD Histogram for Valeant Pharmaceuticals (VRX) on this Weekly Candlestick Chart Shows Buying Momentum that Slightly Decreased Last Week as Compared to the Previous Week

The MACD Histogram readings for VRX on its daily and weekly charts are polar opposites! VRX’s daily candlestick chart shows a MACD Histogram with gradually increasing selling momentum. The MACD Histogram on VRX’s weekly candlestick chart reflects buying momentum that has been starting to slow down 2 out of the last 3 weeks. Both charts cover the same 1 year time period.

Lear how to use the information from different charts and start building expectations for a company’s upcoming chart activity.

VRX – 1 Year Monthly Candlestick Chart

This is the same time period again – 1 year. This is a monthly candlestick chart though. The MACD Histogram readings on the daily, weekly and monthly candlestick charts are all different. While they are all different, they also all fit together to tell a story.

The MACD Histogram for Valeant Pharmaceuticals (VRX) on this Monthly Candlestick Chart Shows Gradually Increasing Buying Momentum Over the Last 2 Months

The daily, weekly and monthly candlestick charts all had different readings on the MACD Histogram over the same 1 year time period.

- The MACD Histogram on VRX’s daily candlestick chart is a short-term reading

- A short-term pullback or consolidation period may be about to start or already started

- The MACD Histogram on VRX’s weekly candlestick chart is a medium-term reading

- The short-term pullback may be more of a sideways correction that a downwards correction since the weekly MACD Histogram reflects buying momentum that is starting to slightly decrease

- The MACD Histogram on VRX’s monthly candlestick chart is a long-term reading

- A long-term uptrend appears in place, buy the short-term dips identified by the short & medium term MACD Histogram readings

- A long-term uptrend appears in place, buy the short-term dips identified by the short & medium term MACD Histogram readings

Comparing the MACD Histogram readings on a company’s daily, weekly and monthly candlestick charts over the same time period helps to build expectations for a company’s share price.

Bullish Divergence

A Bullish Divergence set-up for the MACD Histogram generally represents an early buy signal. Bullish Divergences develop when share prices are falling. At the time of falling share prices, the MACD Histogram shows decreasing selling momentum. Even a slight amount of buying momentum is possible as the share price is trying to bottom.

When a Bullish Divergence for the MACD Histogram is discovered, scan the subsequent activity and look for any sort of price reversal. If there was a price reversal, was there an official bullish reversal candlestick pattern of some sort?

The more indicators that identify a possible bullish reversal, the better the chances are that the Bullish Divergence for the MACD Histogram is an early signal for that trend reversal.

Bearish Divergence

A Bearish Divergence set-up for the MACD Histogram generally represents an early sell signal. A Bearish Divergence is created when share prices are rising. At the time of rising share prices, the MACD Histogram shows decreasing buying momentum or possibly even a slight amount of selling momentum as the share price tends to peak.

When a Bearish Divergence for the MACD Histogram is discovered, scan the subsequent activity and look for any sort of price reversal. If there was a price reversal, was there an official bearish reversal candlestick pattern of some sort?

The more indicators that identify a possible bearish reversal, the better the chances are that the Bearish Divergence for the MACD Histogram is an early signal for that trend reversal.

Tips & Warnings

When selling momentum on a MACD Histogram starts decreasing, start looking for other bullish reversal signals. Other bullish reversal signals include:

- a bullish reversal candlestick pattern

- support at a trendline or moving average

- a bounce from an expected retracement of a previous move

One of the best methods I used when learning how to use various charting tools was practicing with old charts. Analyzing how a MACD Histogram can reflect different readings on a daily, weekly and monthly candlestick chart for the same stock by looking at old chart history is invaluable.

This sort of practicing with old chart history can provide tremendous insight. If you practice on a few charts, I bet you might just agree!

Real Chart Examples

Bearish Divergence

This is a 3 year weekly candlestick chart for Apple (AAPL). As Apple’s share price was making new highs, its MACD Histogram was developing a Bearish Divergence.

As Apple’s (AAPL) Share Price Made New Highs on This 3 Year Weekly Candlestick Chart, Its MACD Histogram Was Flashing Sell Signals

The Bearish Divergence that developed on Apple’s (AAPL) weekly candlestick chart was a foreshadowing of its upcoming downtrend.

After a Bearish Divergence is identified, it becomes extremely important to look for other bearish signals that indicate the end of a trend. The Bearish Counter-Attack candlestick pattern that developed the week of April 27, 2016 in the middle of the bearish divergence was another bearish reversal warning.

Bullish Divergence

This is a 3 year weekly candlestick chart for John Deere (DE). As Deere’s share price was volatile and making new closing lows, its MACD Histogram showed decreasing selling momentum at first. Then began an overall increase in buying momentum.

A Bullish Divergence Developed on the MACD Histogram for John Deere (DE) as Seen on this 3 Year Weekly Candlestick Chart

The Bullish Divergence that developed on John Deere’s (DE) 3 year weekly candlestick chart was a foreshadow of its uptrend that began 6 months later.

[/s2If]